Being an Active Investor Helped Me Get a $54k Tax Refund

I made the less exciting decision to replace my windshield for $300 and invest the rest

Recently, my accountant completed our extended 2022 tax returns and revealed an unexpected windfall — a $54k tax refund.

It was the most significant refund I had ever received, and it was all thanks to my status as an active investor with a diverse portfolio, which includes an options trading business, real estate, and Bitcoin mining.

The magic of depreciation and expenses

A substantial part of my tax refund came from owning and operating Bitcoin miners. I was able to write off a fair amount of depreciation and expenses on these miners, spreading it over five years.

This is different from investing in residential real estate, which is depreciated over 27.5 years. Additionally, I am able to write off other expenses, like subscriptions to investing publications and office equipment, similar to what a large business can do.

The dilemma of a windfall

With the news of the refund, I was faced with a pleasant dilemma: how should I spend this $54k? Options like paying down our mortgage or taking a vacation seemed tempting.

However, I initially decided to upgrade my 2005 Honda Accord to a used 2022 Kia Telluride SX. My main concern with the Honda was the night driving challenges due to the worn-out windshield.

At night I had to squint my eyes and look at the lines in the road to safely avoid the glare of oncoming traffic.

After putting down a $5k deposit on a vehicle, I realized I was about to make a costly mistake. Instead of splurging $50k on a used SUV, I chose a more financially prudent choice — replacing the Honda’s windshield for $300.

This was a tough decision because I had taken to daydreaming about pulling up to work and social events in this luxury vehicle with its sleek black exterior and smooth black leather interior. However, this choice saved me a significant sum and meant I could invest the $54k into growing our net worth.

Lessons learned from an emotional experience

This journey taught me two valuable lessons about managing sudden financial gains and the allure of consumerism: 1) surround myself with financially savvy people, and 2) keep my eyes on the prize.

Surround myself with financially savvy people

I spoke with a friend contemplating a similar decision with a 3-row SUV. His choice to stick with his existing vehicle and utilize Uber or public transportation when needed resonated with me. In my case, a pricey SUV was an unnecessary luxury. My 18-year-old Honda, with only 130k miles and running smoothly, is adequate for my three times-a-week commute to work.

Keep my ultimate objective in mind

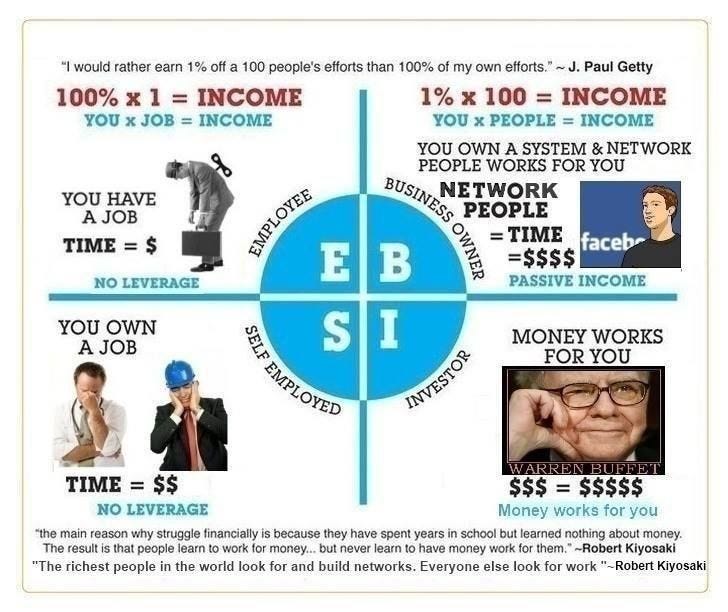

My goal is to retire comfortably and escape the corporate rat race. Spending $50k on a new car would not increase our net worth or cash flow. Investing the $54k in more Bitcoin miners or options trading moves me from being an employee solely reliant on heavily taxed wages to an investor and business owner who benefits from favorable tax treatments.

As Robert Kiyosaki, author of Rich Dad Poor Dad, teaches, to obtain wealth and freedom, we should focus on becoming Business Owners and Investors. We can leverage time and systems by having money work for us. (versus trading our time for money)

In conclusion, this experience with the tax refund taught me the importance of financial discipline and the power of making informed decisions. It’s a reminder that the path to financial independence is often paved with prudent, sometimes less exciting, choices.