The Wild Ride of an Options Trader: Lessons from a Vegas Trip

Vegas, Volatility, and the NVDA Nightmare

In 2022, I was on top of the world in the trading realm. My main options selling account had netted a 38% annualized return, while the S&P 500 had tumbled by 19%. I strutted into 2023 with a swagger, cockiness in tow. Trading, I thought, was a game I had mastered, and I could almost taste the sweet freedom of retirement. I envisioned myself selling options from a beachside hammock or at least from the comfort of my home office.

Breaking the Cardinal Rule

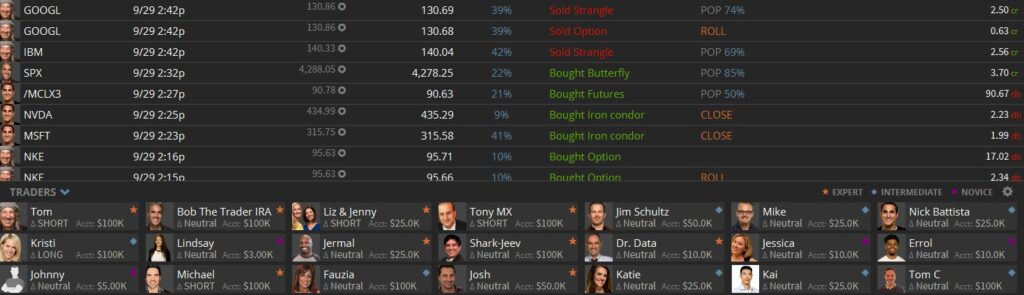

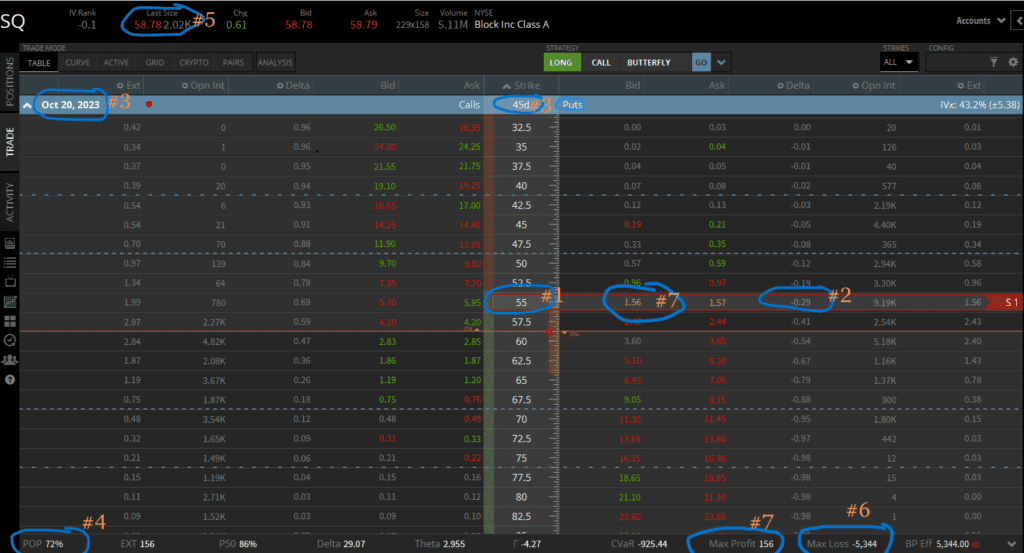

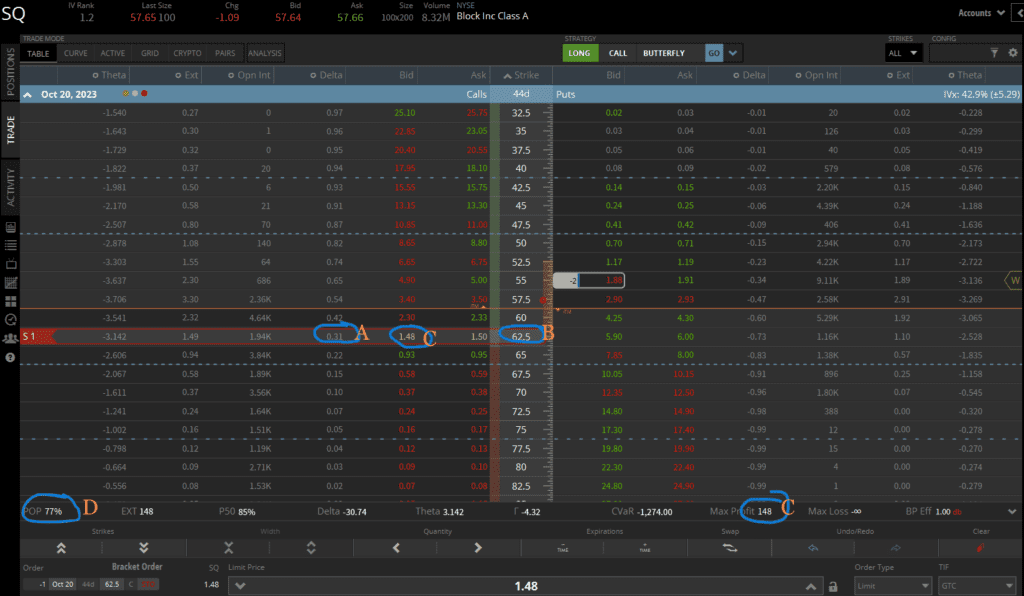

My strategy was simple yet effective: selling Strangles on individual stocks. The plan was always to exit before earnings announcements, avoiding the heightened volatility they often bring. This strategy hinges on the stock price staying within a specific range, ideally moving sideways, enabling me to collect a profit neatly.

Below is an example of a Strangle: a stock is currently trading at $80, and the expectation is that it will maintain its course within the Strangle’s designated range, between $100 on the upside and $60 on the downside.

Unfortunately, in the spring of 2023, I broke my cardinal rule. Distracted by a work trip to Las Vegas, I left Strangles open on NVIDIA Corp (“NVDA”), a stock mired in artificial intelligence hype with a looming earnings announcement. My initial bet was for NVDA to stay within a $40 range. Little did I know, while I was immersed in the Vegas buzz, NVDA’s stock price was preparing to leap.

The Vegas Surprise

Wrapping up my trip, I was greeted by a financial shock. NVDA’s stock had not just breached my set range but had soared way over the expected move overnight, from around $305 to $379. And it didn’t stop there. Over the next three months, NVDA continued its meteoric rise, peaking around $500. My position, which was once hovering around breakeven, plummeted to a staggering $25,000 loss. Profitability on my overall portfolio seemed like a distant dream.

The Rescue Operation

In a state of panic, I reached out to the CEO of TastyLive (Tom Sosnoff) who replied later that night. (In a world where billionaire CEOs are as accessible as a fortress, the CEO of Tasty stood out with a same-day reply, shining a spotlight on Tastytrade’s unparalleled dedication to their customers.) His advice was consistent: stay mechanical. This meant rolling up puts, extending expiration dates, and waiting for the stock to stabilize. There was some comfort in knowing that I wasn’t alone in this predicament; even Mr. Sosnoff himself was nursing a bad NVDA trade at the time.

Without going into every painstaking detail, employing TastyLive’s mechanics religiously over the following months, I managed to pare down my loss from $25,000 to $3,000.

Deciding to Bail

As NVDA approached another earnings announcement, I faced a decision. I could extend the term and continue wrestling with this volatile stock, hoping to break even or eke out a small profit. However, tired and wary of another potential gap-up and potentially bigger loss, I decided to close the trade and accept a $3,000 loss on this position. After all, another artificial intelligence hype story could easily send NVDA soaring again.

Lessons Learned

This experience was a hard but valuable teacher. Here’s what I took away:

· No More Strangles on Individual Stocks: Especially not on stocks in hot industries like AI. The unpredictability is just too high. I’ve shifted to ETFs, which generally tend to be more stable than individual stocks.

· Stay Vigilant While Traveling: Reducing trades or at least monitoring them closely is crucial. Never neglect the account.

· Stay Small: This principle saved me. My initial NVDA position was just ~1–2% of my buying power in this account, allowing me the flexibility to manage the trade through its tumultuous journey.

· The Power of Options Selling: Unlike buying options, selling gives you tools to maneuver and potentially turn a losing situation around. (Had I purchased an option that turned sour, my only recourse would be to sit tight and cross my fingers, hoping it wouldn’t expire completely worthless.)

Looking Forward

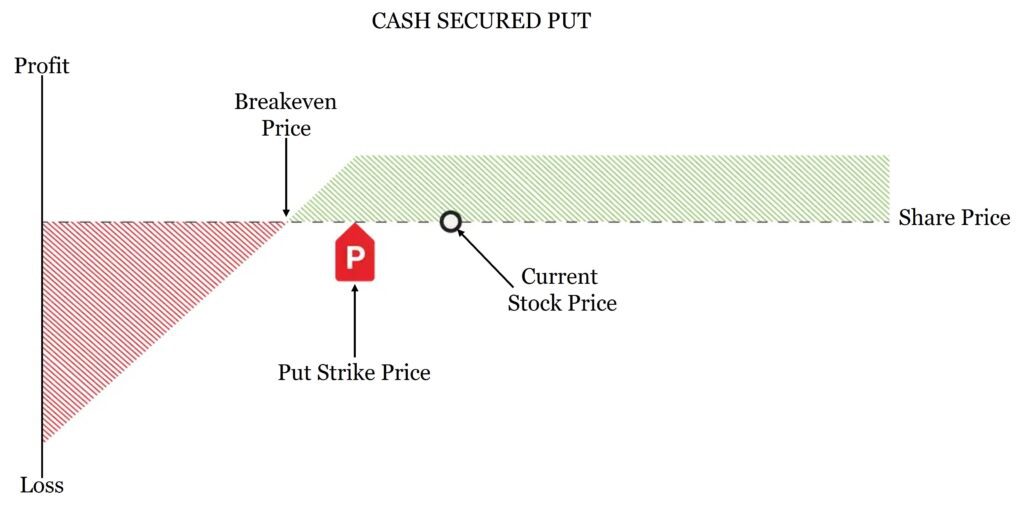

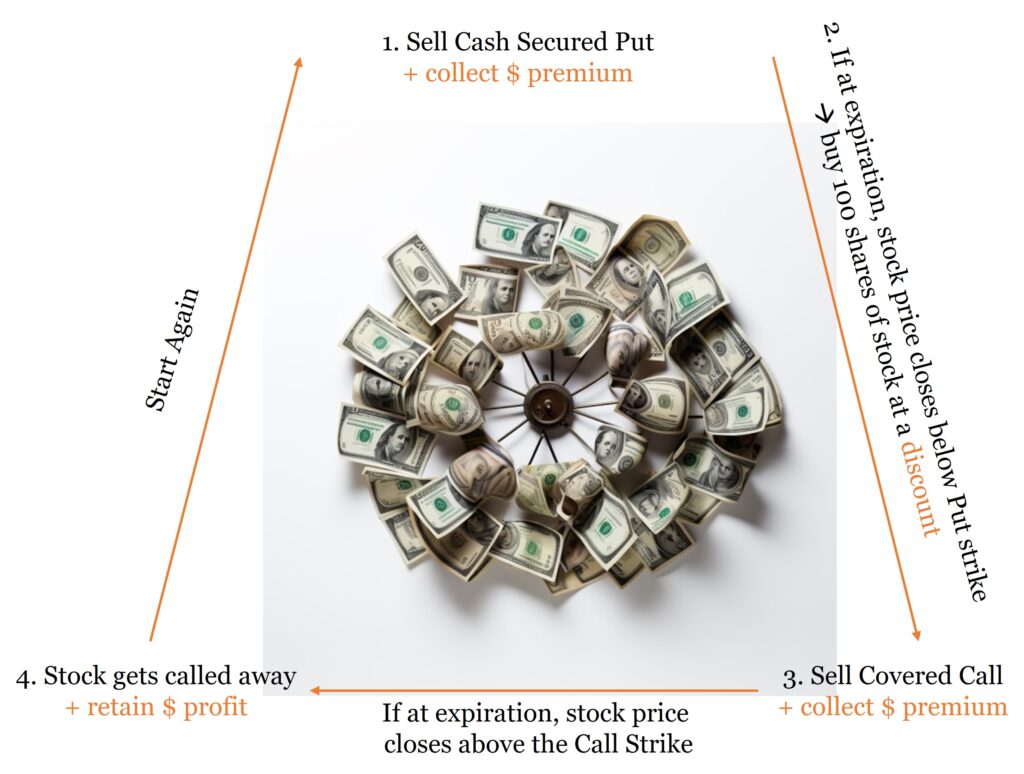

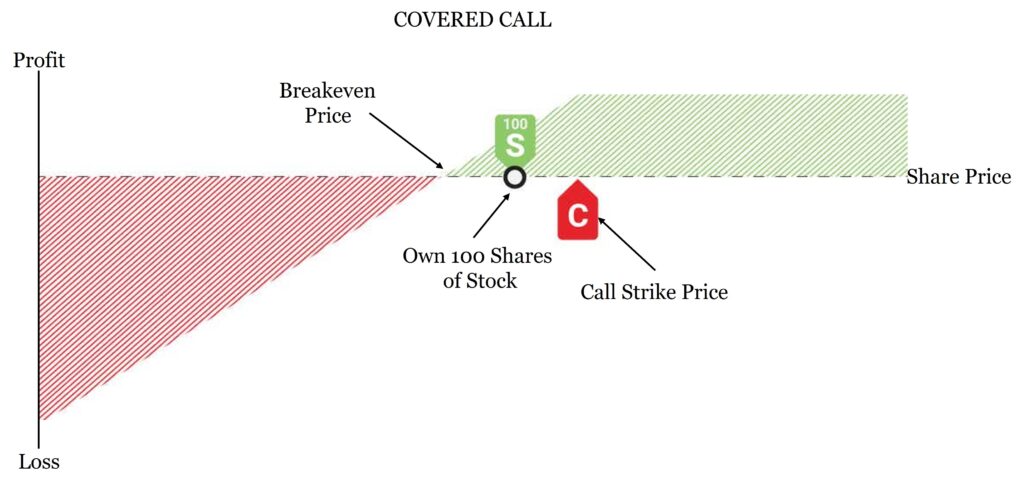

As of now, this options-selling account is only up about 5% this year, trailing the S&P 500’s stellar 20% YTD gain. It is unlikely I’ll hit my target return of 18%; however, I have survived to trade another day. (Conversely, my wife’s retirement account, where we mainly sell Cash Secured Puts and Covered Calls is up an impressive 18%.) This journey has been a testament to resilience in the face of market unpredictability. Happy trading, and remember, the market always has a lesson to teach.