Student Loans Stopped Me from Being a Bitcoin-Millionaire

My wife and I got married in the summer of 2016, right around the time I became debt-free (except for my mortgage). I had committed to not speculating in the markets until all non-mortgage debt was zeroed out. The challenge was my then-fiancé was entering our vows with six figures of student loans from business school. We both had good incomes and diligently paid them off by the following summer.

Early Lessons

I immediately opened an account at Coinbase and deposited $1,000. At the time, you could only buy 3 tokens – Bitcoin, Ethereum, or Litecoin, of which I purchased 1/3 of each. At this time, Bitcoin was trading around $3,500, Ethereum around $300 and Litecoin around $46.

I sometimes look back with a tinge of regret for not investing earlier or not investing more when we got married. If I had simultaneously invested while paying down my wife’s student loans when we got married, we could have purchased Bitcoin around $600, Ethereum around $15, and Litecoin around $4.

I learned a valuable lesson: You can both pay down debt and invest, finding a balance that maximizes your financial growth. There is a sweet spot that allows you to minimize your debt and yet still allow you to invest. I have come to appreciate the approach suggested by the Financial Samurai in determining the optimal ratio of debt paydown to investments. Effectively, allocate 10x the interest rate to paying down the debt, and invest the remaining amount.

In our case, my wife’s loans were with First Republic Bank where she had a 2% interest rate. Based on the 10x rule, Financial Samurai suggests we allocate 20% (2% rate x 10) of the monies to paydown our debt and invest the remaining 80%. Assuming we had paid down her loans by $20,000 and invested $80,000 in crypto, we could have been crypto-millionaires.

The good news is we are still early because: 1) Bitcoin has more room to run 2) Bitcoin is the ultimate hedge against inflation, and 3) institutional adoption is growing. Let us explore these points further.

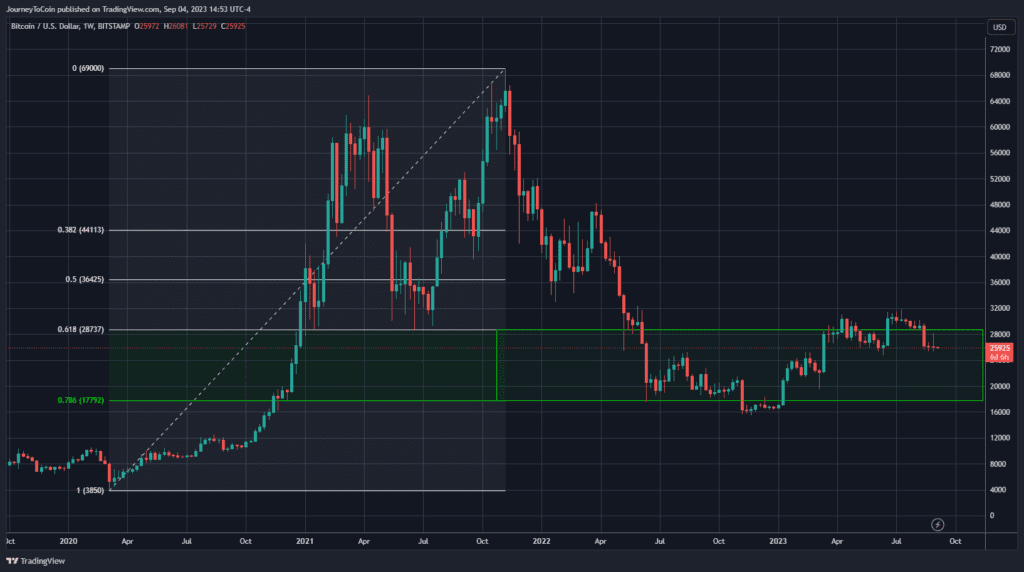

Asymmetric Upside Potential

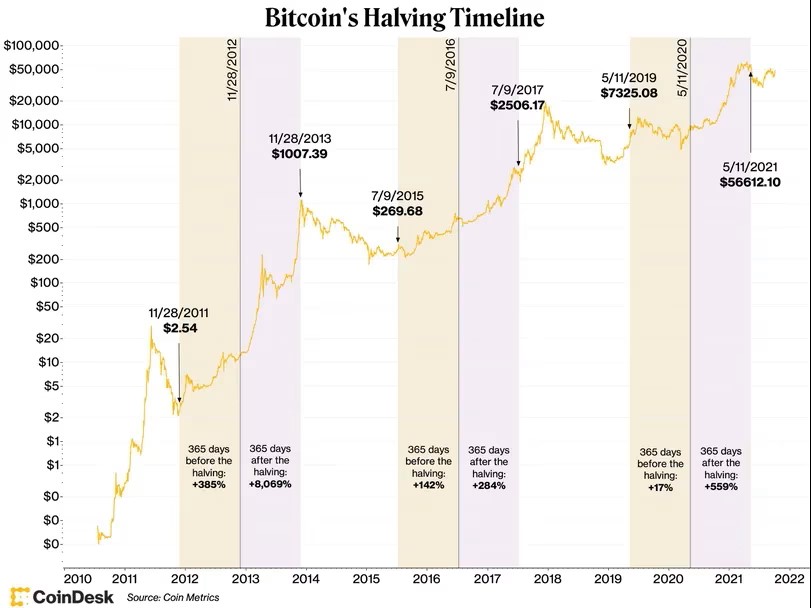

Bitcoin still offers substantial asymmetric upside and is trading well below all-time highs. Bitcoin under $30,000 is on sale with its best days yet to come (as you will see below). Further, the amount of Bitcoins produced continues to get more scarce with the next halving expected around May 2024. (The Bitcoin halving is an event that occurs approximately every four years, where the reward for mining new Bitcoin is halved, effectively reducing the rate at which new Bitcoins are created and thereby limiting the supply.) There is an old saying, “history doesn’t repeat itself but it often rhymes”.

As can be seen in the chart below, after each halving, Bitcoin typically has a nice appreciation in price. The last halving was in May 2020.

So far, we have yet to sell any Bitcoin; however, if price appreciates after the next halving, we will take some chips off the table and move them into our options premium selling account. Selling Bitcoin may not be a tax efficient move; however, selling options has proved a relatively predictable income stream.

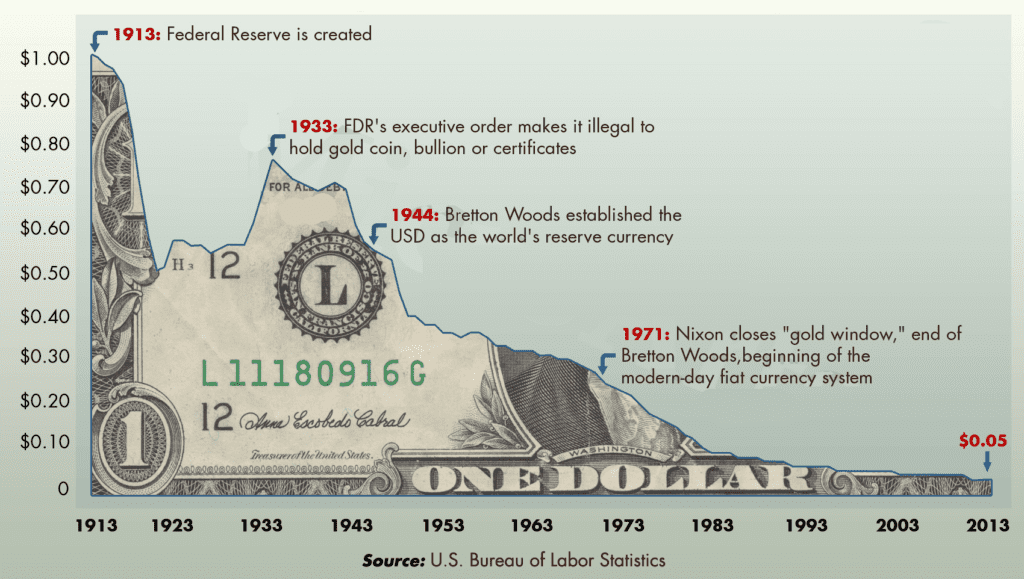

A Hedge Against Inflation

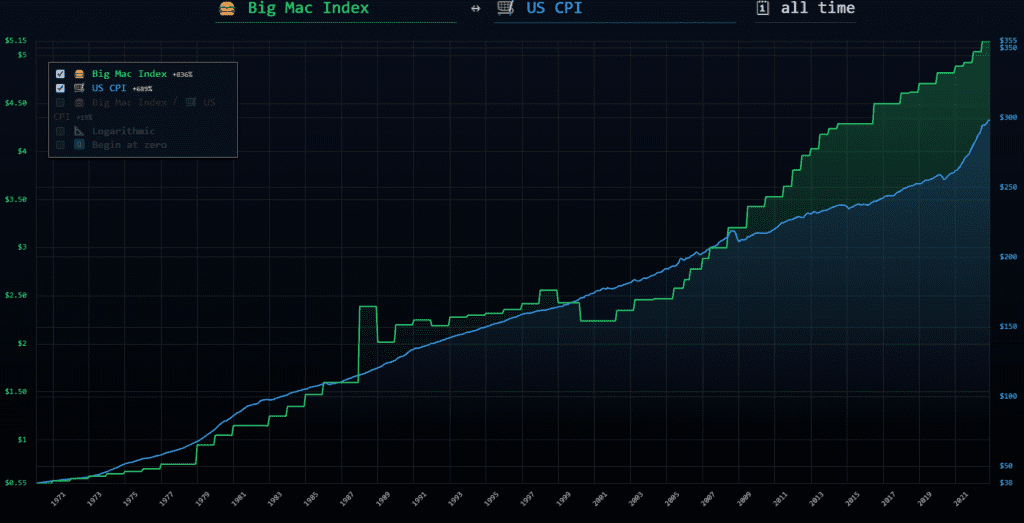

In a world where fiat currencies like the U.S. dollar are continuously devalued due to inflation, Bitcoin stands out as a hedge. Its fixed supply ensures that it does not suffer from the inflationary pressures that plague traditional currencies, making it an attractive option for long-term wealth preservation.

Looking at the Big Mac Index, in December 2022, the average price of a Big Mac sandwich was $5.15, whereas, just ten years ago (December 2012), the average price was $3.96. A 23% decrease in the purchasing power of the dollar in just 10 years.

Bitcoin, with its fixed supply, serves as a hedge against inflation by preserving value in a way that traditional fiat currencies, which can be printed at will, cannot.

Increasing Acceptance and Utility

Initially, Bitcoin was just a darling among some early retail investors. Now, it is gaining acceptance among institutions and even countries. The United States is edging closer to its long-awaited regulations of cryptocurrencies. And the SEC is expected to finally approve a spot Bitcoin ETF by the likes of BlackRock, which will further bring in additional institutional investors.

A few years ago, Fidelity suggested investors should allocate 5% of their investment portfolio to Bitcoin. This recommendation signifies a growing acknowledgment of Bitcoin’s role as an emerging asset class, one that investors can no longer afford to ignore. Our personal allocation to Bitcoin or Bitcoin miners is more than 20% of our net worth. As Bitcoin gains more acceptance, we expect this ratio to rise.

How We Implement Bitcoin in Our Investing Strategy

We continue to dollar cost average into Bitcoin as long as the price stays below $30,000, which I consider to be buying on discount. (We also mine Bitcoin; to be discussed in a separate post.)

We setup automatic buys on the Strike app. You can purchase as little as $1 per day to get your feet wet.

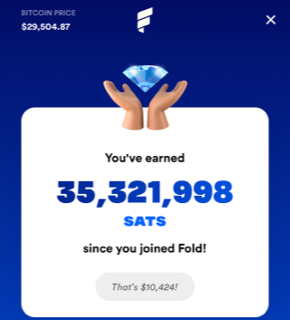

Our favorite way to naturally stack Bitcoin with everyday purchases is on our Fold debit card. We are heavy buyers of Amazon/ Whole Foods where we get 2.5% back. In the less than 4 years since joining, we have gotten back ~$10,000 in Bitcoin rewards.

Conclusion

Whether you view it as a high-risk, high-reward investment, a hedge against inflation, or the future of money, Bitcoin offers a multitude of benefits that make it an asset worth considering for your investment portfolio. The journey into the world of Bitcoin is filled with possibilities, and there is no better time to start exploring them than now.

Happy Investing!