The Freedom of Real Estate Crowdfunding vs. The Hassles of Being a Landlord

In 2003, a couple years after I had graduated from college, I bought a 3-unit rental property in my hometown in Connecticut. I was young, eager, and ready to dive into the world of real estate investing. The problem was, at the time, I was living about two hours away in Boston with plans of moving back to my hometown to be closer to my then-girlfriend. I was intending to house-hack (live on the third floor and rent out the other two units to live rent-free). However, I was working in Boston, and my company ultimately denied my request to move. Further, my relationship with my then-girlfriend had gotten rocky, so I made a major pivot and moved to New York City. Now being almost three hours away, being a long-distance landlord quickly lost its appeal to me. NYC was filled with much more stimuli, and I spiraled into constantly going out – wasting precious money, time, and energy.

Early Mistakes as a Landlord

The few hundred dollars in monthly profits struggled to keep my interest. The only real upside was the income covered my car note on a slightly used Acura TL S (much nicer than the 2005 Honda Accord I currently drive). I also dreaded the constant need to fix things at the property and the hassles of dealing with tenants.

In fact, shortly after closing, I hired a general contractor (who just so happened to be my uncle) for some repairs. Being naïve, I did not even have a written contract. He verbally quoted me ~$6,000 for the work, but by the end of the project, he had added another $6,000 to the bill. I went from having a $6,000 buffer to zero savings. A few years later I sold the property to my sister, where I essentially broke even.

Free of my responsibilities as a landlord, my life continued to nosedive. It would take almost a decade to turn my life around and a few more years before I ventured back into being a landlord. At this point I had developed a healthier relationship with money and my credit score was slowly improving.

In 2016, my sister and I purchased a 6-unit fixer upper for $145k in Connecticut. We put in at least another $100k of cash equity and numerous hours of sweat equity. I was naïve to think it would be like a HGTV episode where we fully gut renovate in only 30 days; 6+ months later we were finally done with the major repairs and ready to start leasing.

Ideally, we would have started with a more turnkey property. However, my credit score was still suboptimal, so we were unable to obtain traditional financing. After some twists and turns, we wound up at a community development fund that provided a mortgage with rates double that of a traditional bank. Not optimal; however, we were momentarily happy to be back in the real estate game. (Will write a separate post of this experience; however, we ultimately sold this property.) It should have been a cash cow; however, there was some overuse of the expense account by my partner, and I continued to dread dealing with the ever revolving door of tenants and upkeep.

I ultimately realized that unless I can invest enough capital to acquire a much larger property with a strong management team, or unless I am house hacking, or I have enough energy to hustle as a fulltime landlord, I am better off investing in crowdfunded real estate.

The benefits of investing in crowdfunded real estate include 1) minimal time and monetary commitment 2) more liquidity, and 3) diversification. Let us explore further.

Minimal Time and Monetary Commitment

A couple of months ago, I opened an account at Fundrise. You can start investing with as little as $10 on Fundrise. I contribute about $400 per month. We invest in what Fundrise calls a Balanced Investing Plan, which seeks to build wealth through investing in assets that provide a mix of cash flow and appreciation in value. Fundrise also offers other plans that focus more on generating cash flow or asset appreciation; there is even a fund that focuses on tech companies in the real estate space.

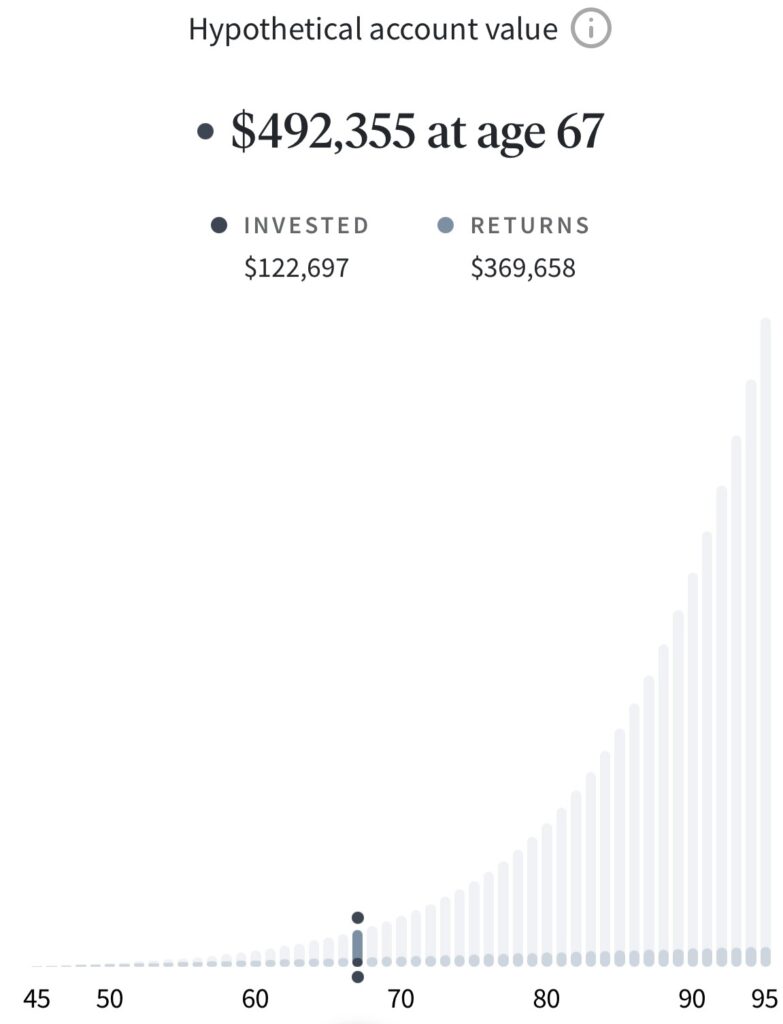

Per Fundrise, the projected return of the Balanced Investing Plan ranges from 6.5% to 15.3% per annum. Assuming I continue to invest $400 per month, in 22 years, my projected return is $369k.

Another benefit of investing in crowdfunded real estate is we still receive the tax benefit of depreciation, which helps to offset passive income. In addition, crowdsourced real estate offers pass through taxation, meaning income and losses are generally passed directly to investors, which means you can offset other income with losses, if any, from your real estate investments. (Unlike publicly traded REITs, which do not offer the benefits of depreciation or pass-through taxation.)

One of the most attractive features of crowdfunded real estate is the minimal time commitment. There is no need to manage properties, collect rents, evict tenants, renovate units, or deal with insurance claims and legal entities. I still reluctantly own a 2-family property in Connecticut. I have so much going on in my life (family, work) that spending even an hour dealing with tenants or contractors feels like a time drain.

More Liquidity

Fundrise allows you to redeem your investments on a quarterly basis. This is in stark contrast to my experience of trying to sell the aforementioned 2-unit property for 12 months without success. After wasting thousands of dollars on moving out a tenant and on repairs, several buyers were ultimately unable to secure financing. So I unwillingly continue to be a landlord, for now.

Diversification

I have only ever owned investment properties in Connecticut as a landlord. Thankfully, with platforms like Fundrise, I can diversify my real estate holdings. Now, I own a diverse pool of assets like single-family rentals, multifamily rentals, and industrial properties in strong markets across the country.

Challenges of Real Estate Crowdfunding

The counterpoint of only investing in crowdsourced real estate is you are not able to fully capture tax benefits, such as writing off expenses for travel, meals etc.

In addition, by only investing in platforms such as FundRise, you may miss out on directly purchasing undervalued assets you could find at foreclosure auctions. I have personally found properties, which have tripled in value in just 3-5 years. In 2017, we purchased the 2-family property for $89k. We have already done two cash out refinances, so technically we have fully recouped any cash equity and the rest is all profit. The challenge as mentioned, is that while the property appraised for $270k (3x the original purchase), it is proving illiquid to sell and somewhat time-consuming. Being a landlord requires a significant time commitment and hustle. As I get older, I instead prefer to sell options from the comfort of my home to generate consistent passive income.

So, there you have it. Unless you are able to invest heavily and hire an experienced property management team, or to roll up your sleeves and hustle, crowdfunded real estate offers a hassle-free and flexible alternative. You still get certain tax benefits, and you do not have to deal with the day-to-day management of properties. It has been a game-changer for me, and it might be for you too.

Happy investing.