Beat the Stock Market by Selling Cash Secured Puts

Ah, stock options. The very mention of them is enough to make many people break into a cold sweat. I get it, trust me. The first time I bought a Call option was back in 2005, and let’s just say it was a short-lived, expensive lesson in what not to do. I had just moved to New York City and discovered Jamba Juice, a smoothie franchise next to my office in midtown Manhattan. Feeling bullish, I invested a few hundred bucks to buy a Call option. A couple of months later? Poof! My money was gone. I was left scratching my head, vowing to never touch options again.

Sell Options for Success

Fast forward 15 years, I thankfully came across Tasty Live, which taught me the fundamentals of selling options rather than buying them. Why? According to an article in Forbes, “90% of options buyers lose money.” I pivoted to the other side of the trade – selling options where my chances of success are much improved.

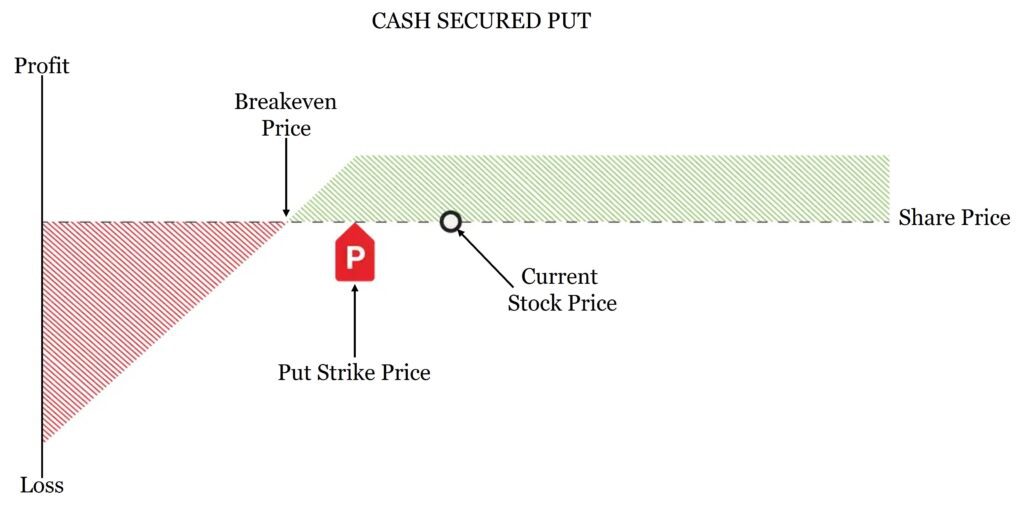

Selling options does not need to be complex, you do not need to be great at math, and you do not need to know all the Greeks. I have found consistent success with the relatively simple process of selling Cash Secured Puts, which essentially means you expect the underlying stock to go higher.

Selling Puts has many benefits: 1) high probability of success 2) lowers the cost basis to outperform the stock market, and 3) provides consistent cash flows. Let us explore these points further.

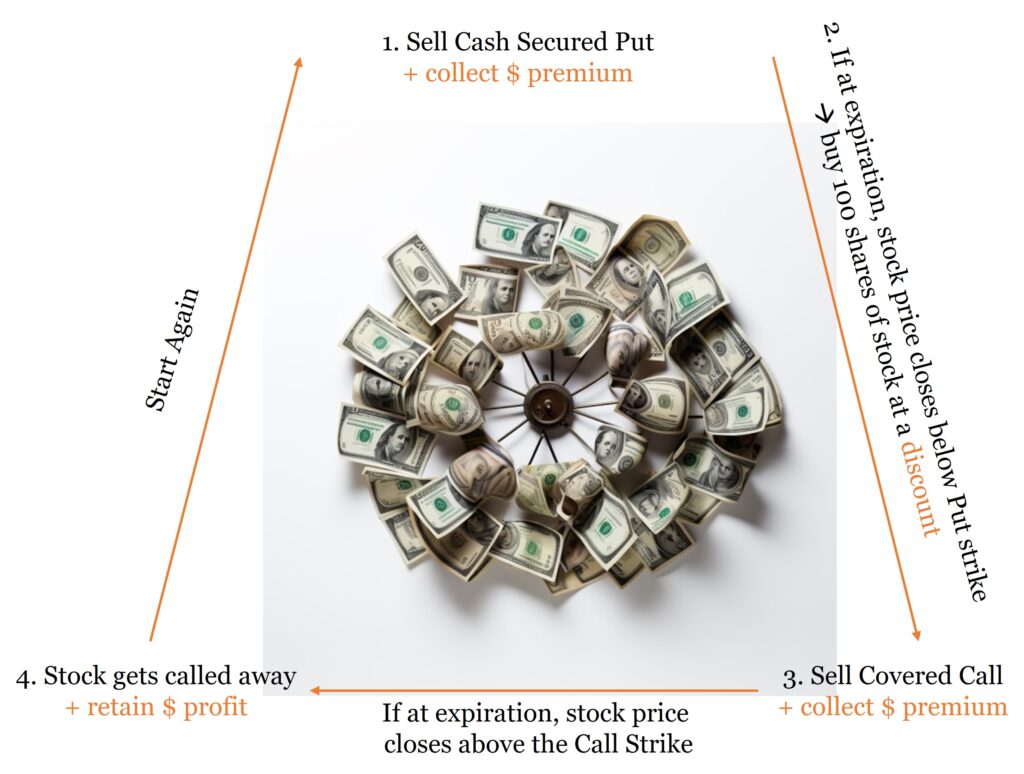

The Wheel Strategy

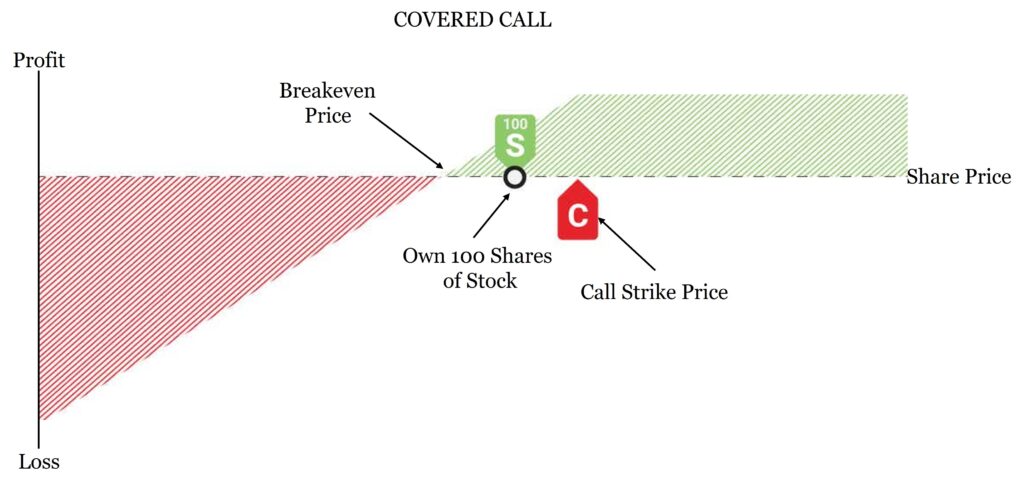

In our retirement and Health Savings Account (HSA), I employ the Wheel Strategy. Essentially, I sell a Put option on an underlying stock or ETF (meaning I expect the stock price to go higher). If, at expiration, the stock price is lower than the strike price, I buy 100 shares of the underlying stock at a discount, at which point I sell a Call option on the 100 underling shares.

The results speak for themselves. Since starting to sell options in our HSA in 2020, I am up approximately 30% year-to-date, outperforming the S&P 500 (up around 16%). Over the past three years, I am up a cumulative 125%.

While our HSA is on the smaller end (~$15k), it is empowering to generate consistent market-beating profits by selling options regardless of whether or not we are in a bull or bear market.

How I Sell Cash Secured Puts

Recently, I sold a Put in Block, Inc (NYSE: SQ) for my wife’s Individual Retirement Account (IRA) because the premiums I collected met our target returns (at least 2% return for the 30-45 days I am in the trade). In addition, SQ is a company I do not mind owning if our option gets exercised.

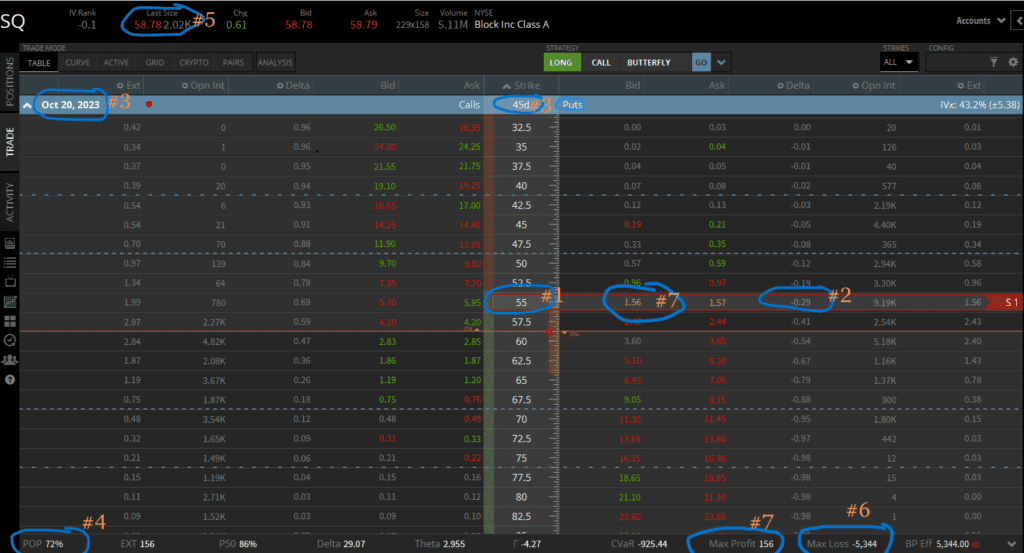

Shown below is the order entry screen on Tasty Trade.

High Probability of Success

I typically look to sell the 30 Delta Puts, which signifies there is an approximate 30% chance the stock will close below our strike price, and I will end up owning 100 shares of the underlying stock. In other words, there is an approximate 70% chance of a successful trade where the stock price remains elevated, and I collect the premium and move on.

In our example, I sold the $55 Put (#1 in the chart above) with a 29 Delta (#2); expiration date of October 20th or 45 days from when we originally put on the trade (#3). The Probability of Profit (POP) is 72% (#4), which means there is a 72% chance I make at least $0.01 on the trade.

Lower Cost Basis

Instead of selling the $55 Put, I could have just bought 100 shares of SQ at its then trading price $58 (#5), which would have cost ~$5,800 for 100 shares. However, by selling the $55 Put, if the stock price is below $55 at expiration, I will end up owning the 100 shares for $5,344 ($55 Put x 100 shares = $5500 – $156 initial premium collected.); #6 in the chart above. So inherently, you are advantaged by selling a Put to reduce your cost basis versus buying the stock outright. This is a $456 discount on a stock I want to own stock.

Consistent Monthly Cash Flows

I typically look to sell options that expire in 30 to 45 days. After I sell the Put, I immediately place an order to close the trade (aka buy back the Put at a lower price) to retain 90% of the premium I had initially collected. In this way, I set it and forget it, until I get an alert the 1) trade was profitably closed and I keep the net premium, OR 2) stock price closed below the strike price at expiration, and I now own 100 shares of the stock at a discount.

In our example, I initially sold the Put and collected a premium of $156 (or $1.56 x 100 shares); #7 in the chart above. I target buying back the Put (aka closing the trade at a lower price) at 10% of the initial premium collected.

I immediately set a standing order to buy back the Put at $0.15 (10% of the initial $1.56 premium) to potentially book a profit of $140 ($156 initial premium – $15). People typically think “buy low and sell high”. In the case of selling options, we first “sell high and then buy low”.

The expected ROE on this trade is 2.5% ($140 net premium /$5,500 initial investment); assuming I exit at 45 days, the annualized return is 20.6%; not too shabby. (Subscribe to the Reclaiming F.I. Newsletter to receive a free return calculator spreadsheet.)

This strategy is a boon for retirees or anyone looking for enhanced supplemental income, especially when dividend investors typically expect to collect 2-5% dividend yield per annum.

The Wheel in Action

Continuing with our example, if at expiration the price of SQ stays above the strike price of the $55 Put, I keep the initial premium collected, and move on to our next trade. However, if the price of SQ is below $55 on expiration, our Put option will get exercised and I will buy 100 shares of the underlying stock. This is when the Wheel Strategy comes into play. I typically sell a 30 Delta Call on the 100 shares of stock; this is what is known as a Covered Call. Again, the 30 Delta means there is an approximate 70% chance the stock price will stay below this strike price.

Selling a Covered Call

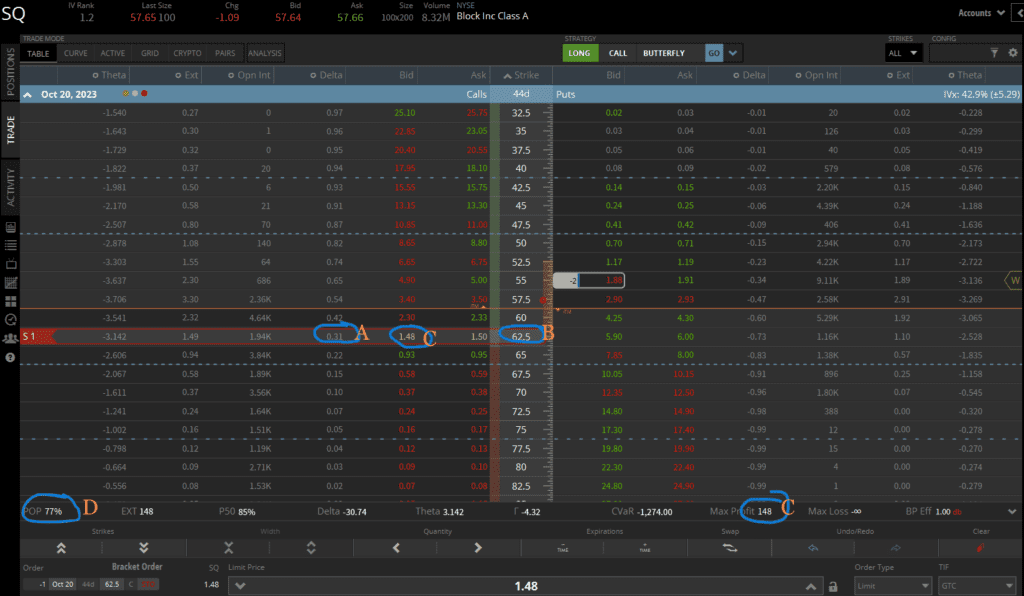

In the example, if the Cash Secured Put is exercised and I buy 100 shares of SQ, I would then sell the 31 Delta Calls (A in the chart above) at the $62.50 strike price (B) and I would collect the initial premium of $148 ($1.48 x 100 shares); C in the chart above. The Probability of Profit is 77% (D).

Again, I would immediately place a standing order to close the trade (aka buy back the Call at the lower price) at 10% of the initial $1.48 premium collected (or ~$0.15). If at expiration the price of SQ is under the strike price, then I keep the premium and the 100 shares of the underlying stock. Then I repeat the process and sell another ~30 Delta Call against our 100 shares.

Conversely, if the price of SQ is higher than the $62.50 strike price, then the underlying stock gets Called away from us and I retain the profits. Our expected return on selling a covered Call is 2.4% ($133 net premium /$5,500 initial investment); assuming I exit at 45 days, the annualized return is 19.6%.

Conclusion

Selling options has been a cornerstone strategy for me, and it has helped me to generate consistent returns while managing risk. If you have been skeptical about options, or worse, burnt by them, I urge you to reconsider and to explore the selling side. With the right education and approach, it can be a win-win situation. Happy trading!