Five Steps to Financial Freedom

Achieving financial freedom is not complicated. It, however, does take time. It’s all about creating a plan and sticking to it. I wish someone had taught me this in high school or college. Thankfully, I came across Dave Ramsey 11 years ago, and that kickstarted my journey. However, it took me another few years to discover the FIRE (Financial Independence, Retire Early) movement. If I had to do it all over again, I would have focused on achieving financial freedom as soon as possible. In this blog post, I’ll share my take on the five steps to financial freedom, combining wisdom from different financial philosophies.

Step One: Start an Emergency Fund

The first step is crucial. Start by setting up an emergency fund of at least $1,000. I heard a statistic that most people do not have access to $1,000 if an emergency strikes. Having this cushion will provide the peace of mind to tackle the next steps in your journey. In addition, this buffer will reduce the temptation to dip into your investment account for any unexpected purchases. It’s like a safety net that keeps you from financial strain when life throws a curveball your way.

Step Two: Pay Down Debt While You Invest

Dave Ramsey advises paying off non-mortgage debt before investing; however, I now believe in a balanced approach. I particularly like the 10x Rule from Financial Samurai. This rule suggests paying down any debt by 10x the interest rate being charged and investing any remaining free cash flow. For example, if you have a student loan with a 2% interest rate, allocate 20% of your extra cash to paying down the debt and invest the remaining 80%. This strategy allows you to grow your wealth while also becoming debt-free.

Step Three: Invest 10% to 50% of Your Income

Here’s where the rubber meets the road. You need to invest at least 10% to 50% of your income in a non-retirement account. In my opinion, you should contribute just enough to your 401(k) to get the employer match and no more. Forgo the IRA for the time being. Instead, channel your resources into your non-retirement account to optimize your financial freedom. You can’t easily access money in retirement accounts like IRAs and 401(k)s before you reach a certain age, typically 59½, without incurring penalties. You need to build enough passive income in non-retirement accounts so you can retire early if you choose.

If I were just starting out, I would set up an automatic investment plan into a diversified, low correlated, portfolio of up to five ETFs. For example, consider investing in the following ETFs:

- SPY (stock market index that measures the performance of 500 of the largest companies listed on stock exchanges in the United States). Average return since inception of 10% per annum.

- BITO (Bitcoin futures ETF) with only a 0.30 correlation to the S&P 500

- TLT (Treasury bonds ETF) with only a 0.36 correlation to the S&P 500

- XLE (energy ETF) with only a 0.28 correlation to the S&P 500

- IYR (real estate ETF) with a 0.66 correlation to the S&P 500

I would invest in these funds every time I got paid, regardless of what was happening in the overall stock market – bear or bull market.

Step Four: Let Compound Interest Work Its Magic

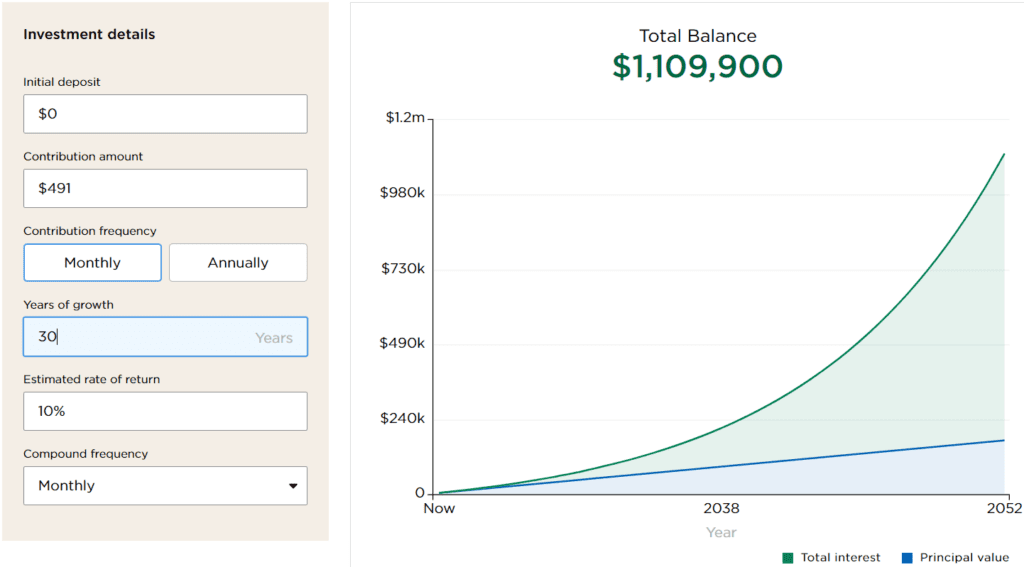

Compound interest is your best friend on the road to financial freedom. To put this into perspective, according to the US Bureau of Labor Statistics, the average income per person is approximately $59k. If you invest just 10% of that income ($491 per month), assuming a 10% annual return, you will have $1 million in liquid assets in 30 years.

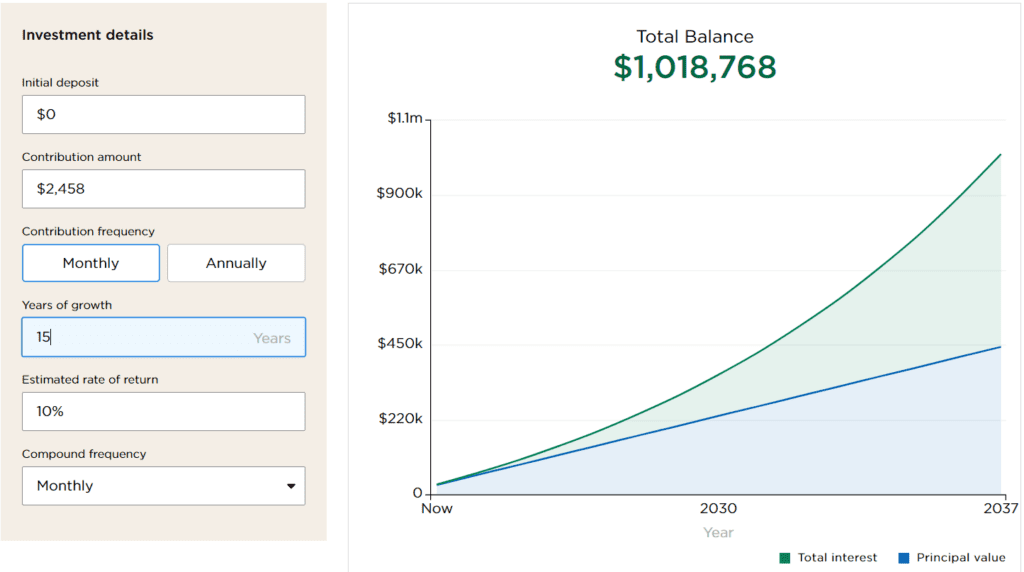

If you go all out and invest 50% of your income ($2,458 per month), you will reach that $1 million milestone in just 15 years. I wish I had begun this way 22 years ago when I started working; however, it’s never too late to begin.

Step Five: Optional Steps for Enhanced Financial Freedom

This step is for those who want to take their wealth-building to the next level. You could learn to sell options like I do, mine Bitcoin, or even start a small business. The goal is to find ways to maximize your returns. For example, by actively selling options, you can reasonably expect to make at least an 18% annual return (~2x passively investing). Alternatively, you could invest in real estate or any other ventures that interest you.

Conclusion

The key to financial freedom is to start investing and to stick to the plan. Whether you’re following Dave Ramsey, the FIRE movement, or my approach, the most important thing is to start and stay consistent. Your future self will thank you. As someone who’s navigated through various financial philosophies, I can say that while the journey may be long, the destination is worth it.