Decentralized Dollars: My Helium Antenna’s Profitable Discovery

Earning $80 a Month from Helium Mobile

At the beginning of the new year, amidst a quiet morning, I found myself rummaging through the digital cobwebs of my old crypto wallets. It was akin to flipping through a dusty photo album, each altcoin a snapshot of a different era in the ever-turbulent crypto universe. Among these digital relics, my thoughts turned to a piece of tech silently residing in my attic: a Helium antenna.

Helium is a project straight out of a tech utopian novel. It’s about constructing decentralized wireless infrastructure, a kind of people’s Verizon, if you will. But unlike Verizon, with its towering infrastructure monoliths, Helium takes a more grassroots approach. It uses hotspots hosted by individuals (like yours truly) to weave its network fabric. These hosts, in return, receive compensation in cryptocurrency.

For the past three years, through the bleak crypto winter, my Helium hotspot sat in my attic, humming a tune I had almost forgotten. As someone who had edged towards Bitcoin maximalism, casting a skeptical eye on all altcoins, I wasn’t expecting much.

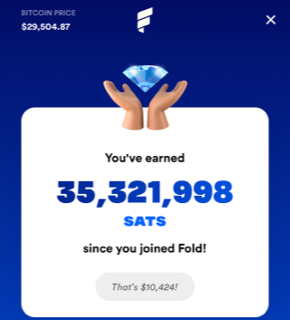

But life has its ways of surprising you. When I checked my Helium wallet, there it was — over $1,000. This tidy sum not only reimbursed the initial $400 investment for the hotspot but also left a neat profit. Not a retirement fund by any means, but a pleasant surprise nonetheless.

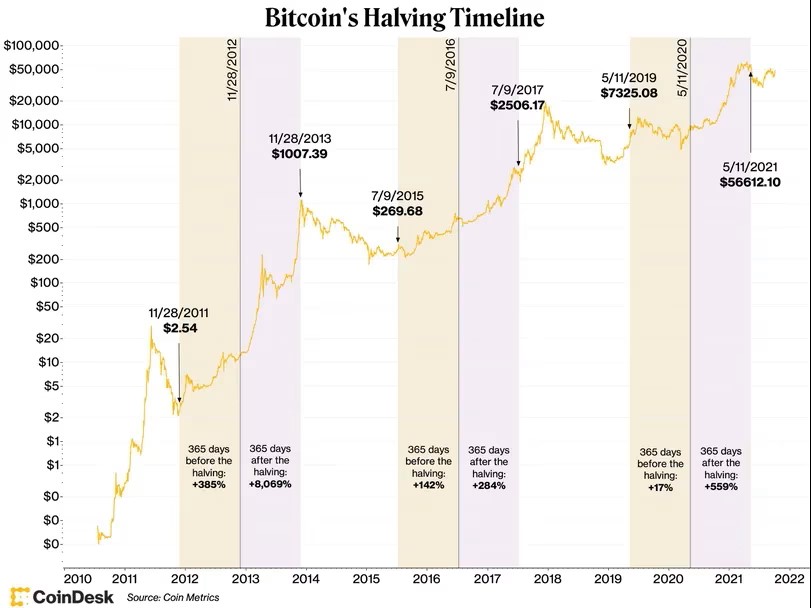

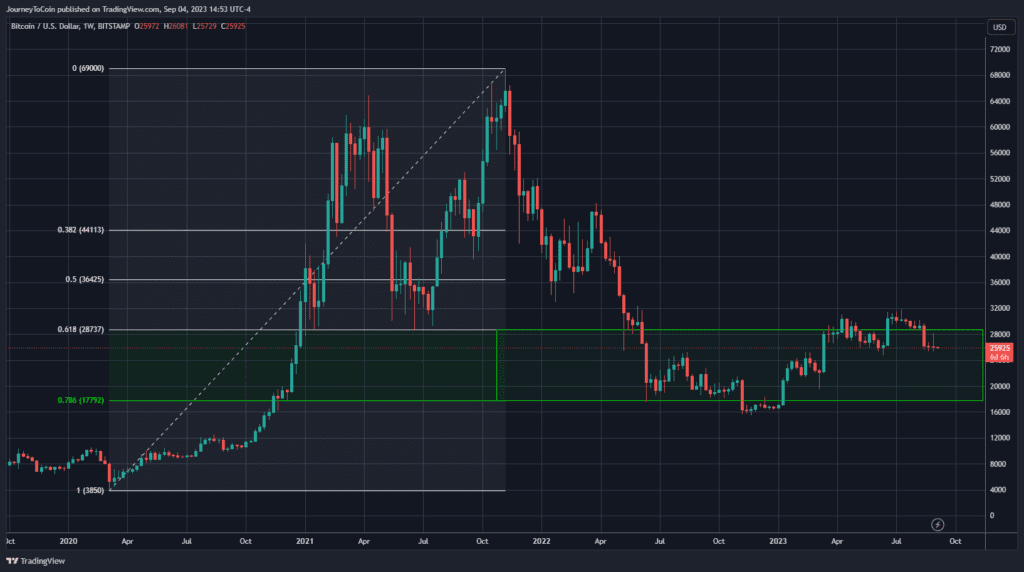

Now, here’s where the plot thickens. Helium (HNT), which is trading around $6 at the time of this writing, had its heyday at over $50 in the last bull run. If — and yes, it’s a big ‘if’ — it hits those highs again, my modest $1k could balloon to over $8k. In my opinion, we are in the early stages of the next crypto bull run with plenty of upside.

During the crypto winter, the Helium team wasn’t just hibernating; they were busy at work, crafting something new — Helium Mobile a decentralized wireless network. Skeptical but intrigued, I decided to give it a try, bidding adieu to my decade-long relationship with Verizon Wireless.

One week into using Helium Mobile, I am pleasantly surprised. The service quality? Indistinguishable from Verizon. The cost? A fraction, at $20 per month. And here’s the kicker — I’ve already earned $26 in MOBILE tokens, enough to cover the monthly cost and then some. If this trend continues, I could be making over $80 a month just by using my phone!

This experience feels almost too good to be true. For the longest time, I was a skeptic of all altcoins. However, Helium Mobile seems to be a worthy use case of the blockchain.

So, for those on the fence, why not give Helium Mobile a whirl? You might just find yourself pleasantly surprised, just as I was with this forgotten antenna in my attic. Who knows? It could be the beginning of a new chapter in your digital adventure.